ELIGIBILITY:

Q: Am I eligible for a scholarship?

A: You are eligible if:

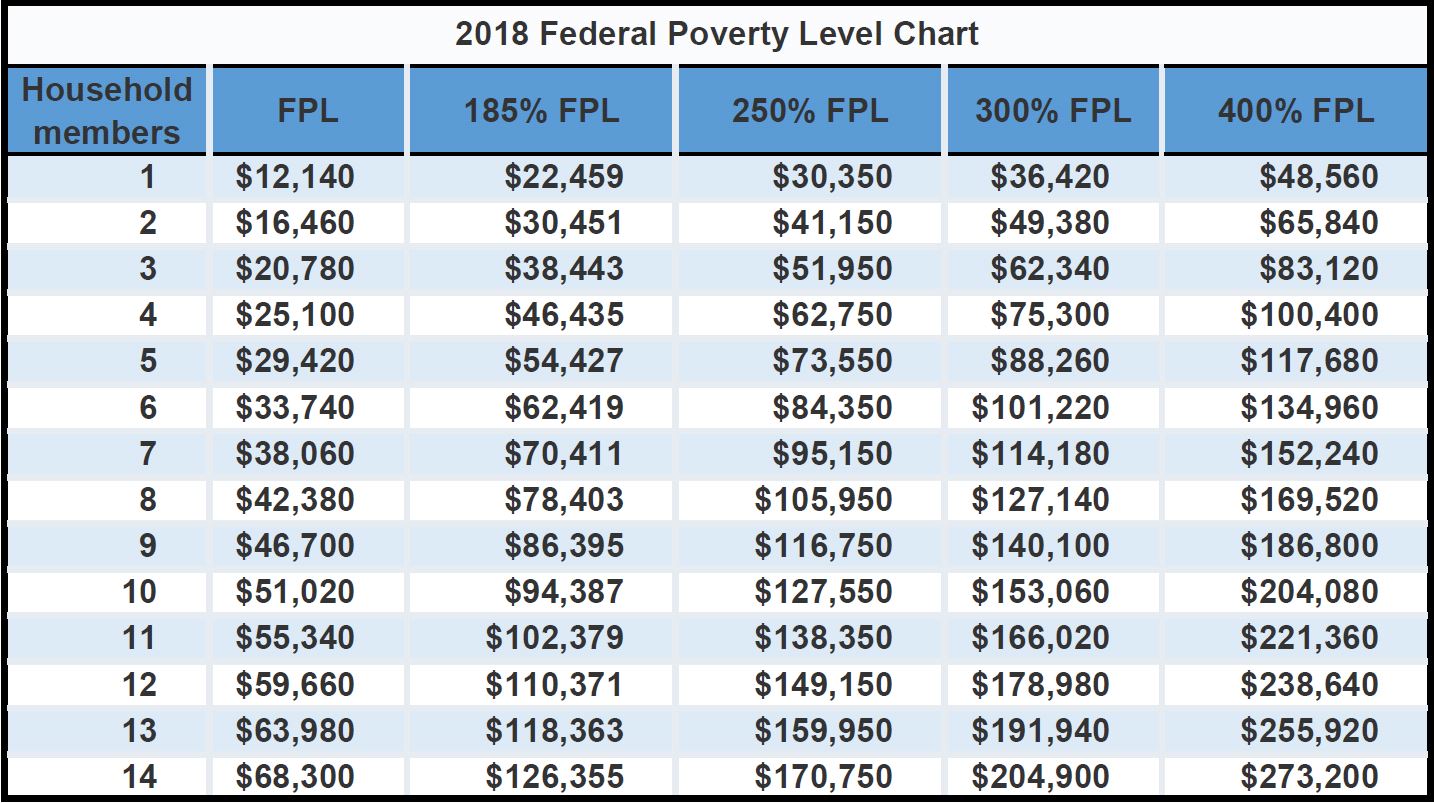

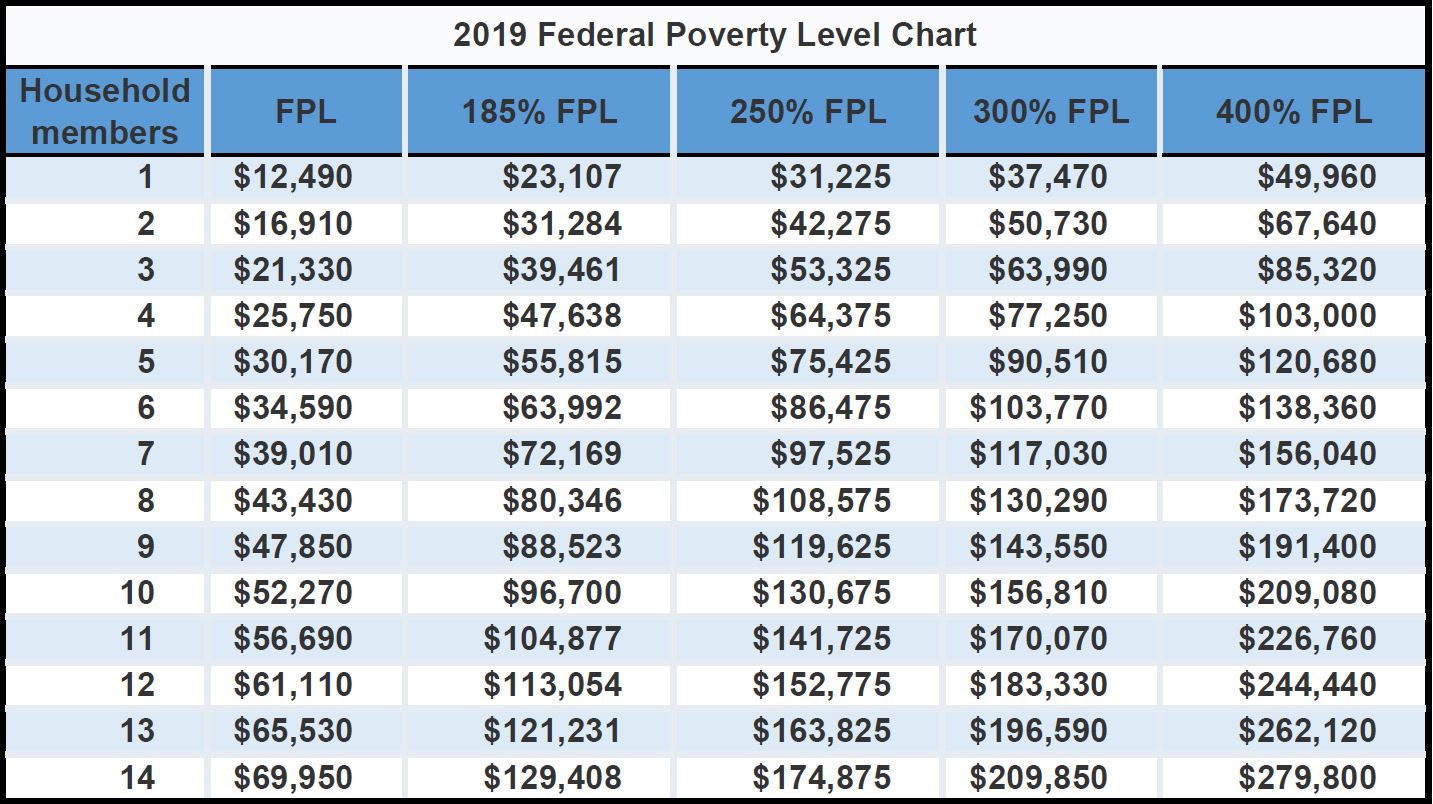

- Your household AGI (adjusted gross income) from 2018 or 2019 doesn’t exceed 300% of the federal poverty line (FPL). See below for the FPL charts. Note: AGI excludes certain tax-exempt income, such as parsonage

- If a child received a tax credit scholarship from an SGO during the 19-20 school year, the child remains eligible if the household’s AGI doesn’t exceed 400% of the FPL.

|

|

Q: What is AGI and where can I find it?

A: AGI stands for adjusted gross income which is your total gross income minus specific deductions. You can find your AGI on the first page of your FEDERAL form 1040 tax return, line 7. Please note, this is NOT form IL-1040.

Q: Are the eligibility guidelines based on 2018 or 2019?

A: You can apply using either your 2018 or 2019 AGI. The number of household members needs to match up with the year that you use to prove your income. For example, if a family had an additional child in 2019 they would not be counted as a household member if the family applies using their 2018 income information.

Q: Do I need to submit both my 2018 and 2019 documentation?

A: Either your AGI from your 2018 federal tax returns or your 2019 income listed in your W-2s, 1099s and/or pay stubs.

NOTE: Families with more than 4 children who plan to use their 2018 Federal tax return as proof of income, address and family size must upload their entire 2018 Federal tax return (form 1040). Uploading only the first page is not sufficient, as it only shows a maximum of 4 kids.

Q: What can I use to prove my eligibility?

A: Either your AGI from your 2018 federal tax returns (pages 1 & 2) or your 2019 income listed in your W-2s, 1099s and/or pay stubs.

Q: Can I prove eligibility with documentation from WIC or SNAP benefits?

A: If your federal tax return is not available to you and you receive WIC or SNAP benefits, you may submit your statement of WIC or SNAP benefits as proof of income.

Q: Do I need to submit proof of Illinois residency?

A: If your current primary home address is listed on your 1099, W-2 or federal tax return that is sufficient proof of Illinois residency. If the address is not listed, is incorrect, or is not your primary residence you will be required to submit either a driver’s license or utility bill to prove Illinois residency. Proof of IL residency is only required for the spouse that submits the application.

APPLYING:

Q: How can I apply?

A: Applications will be available on through 2 SGOs (Scholarship Granting Organizations). The application will open on January 14th at 8AM for Big Shoulders and January 15th at 7PM for Empower Illinois. There will be a very short application window, as the funds will only be available on a first-come first serve basis. Therefore, it is imperative to be fully prepared.

Q: Will there be an application event?

A: Yes, this year Agudath Israel will be hosting two community-wide application events and we encourage all eligible families to attend.

- On the morning of January 14th for Big Shoulders Fund. Doors will open at 6:00am. Submission at 8:00am.

- On the evening of January 15th for Empower Illinois. Doors will open 5:00pm. Training will start approx 5:30, event starts at 6:30pm, final submission at 7:00pm.

Q: How do I access my AISGO account?

A: Each family has their own username and password which was emailed/mailed out. If you have not received it or have issues logging in, please contact the JDBY-YTT STC Helpdesk at stc@jdbyytt.org or 773-465-8889 x680.

Q: How does the application work?

A: The application requires 2 parts:

Stage 1: The application goes live and parents submit a short form to receive a timestamp. Scholarships will be awarded first-come first-serve based on this timestamp.

Stage 2: After stage 1 has been processed, links will be provided to complete the full application. This part of the application will require household and income documentation. Families who don’t complete stage 2 of the application before the deadline may suffer potential consequences.

AISGO PRE-APPLICATION:

Q: What if I don’t know what school my child will be attending?

A: If you are unsure which school your child will attend you may list more than 1 school. No awards will be finalized until enrollment has been confirmed by your school of choice.

Q: How do I know if my child is classified as “gifted and talented” or an “English Language Learner”?

A: A student is considered “gifted and talented” if they scored in the 95th or higher percentile in any subject on their 2018-19 standardized testing. An “English Language Learning” is any child who qualifies for Title 1 funding for speech. The school will notify parents if their child is considered “gifted and talented” or an “English Language Learner.”

Q: How do I know if my child is eligible to receive services under IDEA (special needs)?

A: Your child is eligible to receive services under IDEA if they have either an IEP or ISP for individualized services.

Q: What is the definition of “parents, adults, and dependents”?

A: The definition of dependents is not based on age. If you have someone who lives with you but is not listed on your tax return (e.g. grandmother) you count them as a dependent. If they’re on your tax return but don’t live by you (e.g. young married couple being supported and don’t file), they are not counted. You do count older boys and girls that dorm in yeshiva or are in seminary.

Q: What if the number of adults/dependents has changed since the tax form was filed? (a child was born, a child got married, etc.)

A: List the number of adults/dependents that correspond to the year you are reporting your income from. The number does not necessarily have to be what is listed on the tax return.

Q: Why doesn’t it allow me to make changes when I log back into my account?

A: If you are logging back into your account to make changes you must click the red button in the top right corner that says “to modify your information, click here.”

Questions:

Q: Who can I contact with further questions?

A: Feel free to contact our STC Helpdesk at stc@jdbyytt.org or 773-465-8889 x680.